BlackBull Markets

FMA, FSA

- Available to residents of New Zealand – unlike many brokers that don’t have the required full FMA license.

- Provides the full MetaTrader suite (MT4 and MT5).

- Supports multiple third-party copy trading platforms, such as ZuluTrade and Myfxbook.

- Integration with the TradingView web platform was made available in 2021.

- Besides in New Zealand, lacks additional tier-one regulatory licenses, such as within the EU.

- BlackBull’s Seychelles-licensed entity only offers light regulatory protection.

- The narrow scope of BlackBull’s research and educational content can’t compete with what the best MetaTrader brokers offer.

- Based on the average spreads we obtained, commissions and fees at BlackBull Markets appear to be in line with the industry average.

- With only 281 symbols available for trading on MetaTrader, BlackBull Markets trails the best forex brokers.

Company Details

Founded in 2014, Black Bull Group Limited (BlackBull Markets) offers access to thousands of instruments on industry-renowned and proprietary trading platforms. The broker is headquartered in Auckland, New Zealand.

The company founders offer 10+ years of combined institutional experience in the forex space. The broker is a true ECN, no dealing desk brokerage, providing institutional-grade fintech services to retail clients.

Today, BlackBull Markets serves over 20,000 day traders across 180+ countries.

The broker is licensed by the New Zealand Financial Markets Authority (FMA) and registered as a security dealer by the Financial Services Authority (FSA) of Seychelles.

Trading Platforms

BlackBull Markets offers several platform options so there is something for everyone. This includes a proprietary shares app plus MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 and MT5 are available for download to Windows and Mac devices or can be used via all major web browsers. Download links are available on the BlackBull Markets website.

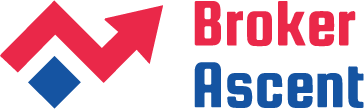

MetaTrader 4

The MT4 system is the go-to option for many brokers and traders. The platform offers near-instant execution speeds, interactive charts, and direct market trading using prime liquidity providers. The platform supports Expert Advisors (EAs), as well as MetaScripts, which allow you to create your own automated robots.

Traders can also access multiple order types, 30+ pre-installed indicators and analysis tools, nine timeframes, one-click order execution, multiple chart set-ups, and a market watch window.

The WebTrader eliminates the need to install any additional software and offers all the same benefits as the desktop version, including drawing tools, financial news and live pricing.

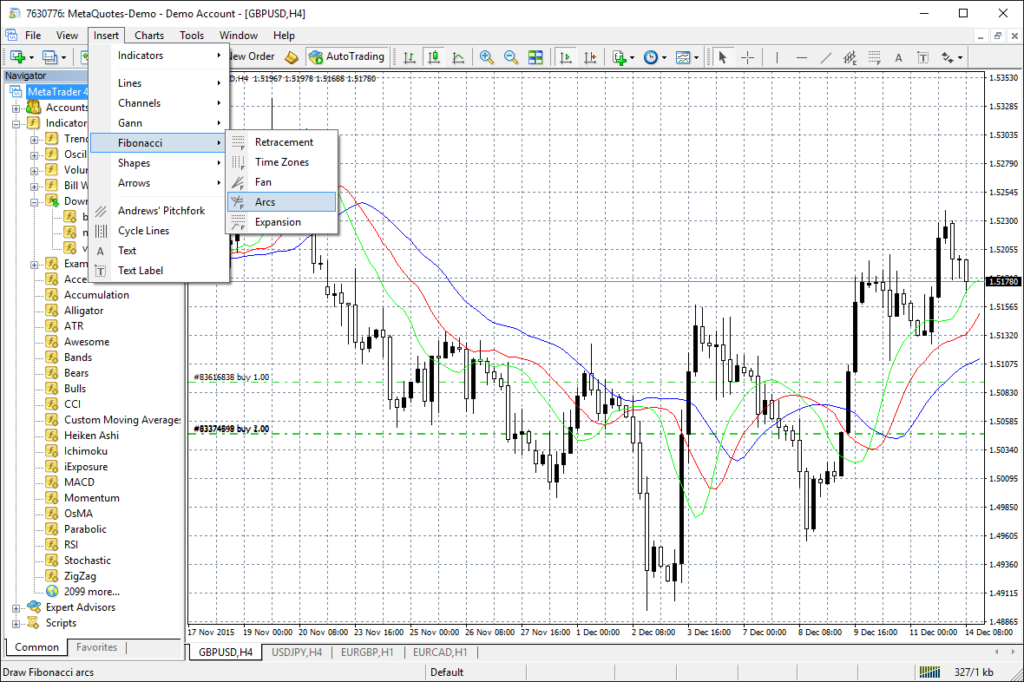

MetaTrader 5

MT5 offers advanced financial trading functions. This includes comprehensive price analysis, the use of algorithmic trading applications and copy trading.

In addition, users can benefit from access to superior tools for technical and fundamental analysis, hedging capabilities and advanced pending order functionality. Other key features include 21 timeframes, 38 built-in indicators and an integrated economic calendar.

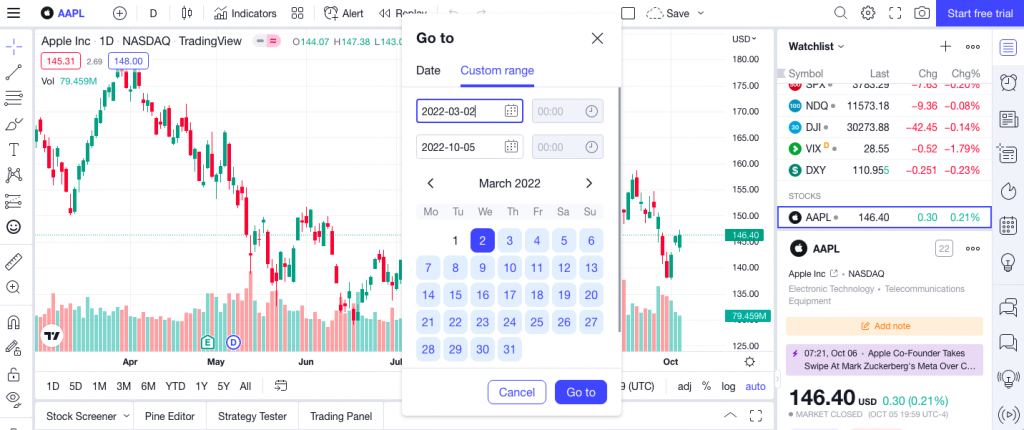

TradingView

The broker also offers TradingView as an alternative platform. The world’s leading charting and social trading platform can be used on both desktop and mobile devices. The terminal provides access to 12 chart types, 100+ pre-built indicators, 50+ drawing tools and multi time-frame analysis.

The interface is modern, with clear navigation and customizable features.

BlackBull Shares

BlackBull Shares is the broker’s proprietary mobile app providing access to global share trading across 80+ markets. It is available for free download to iOS and Android devices. When we used BlackBull Markets stocks application, we were impressed with the one-stop shop to trade and manage your account whilst on the go.

Key features include:

- 70+ order types

- ESG dashboard filters

- Extended trading hours

- Advanced analysis tools

- Data feeds from 66+ third-parties

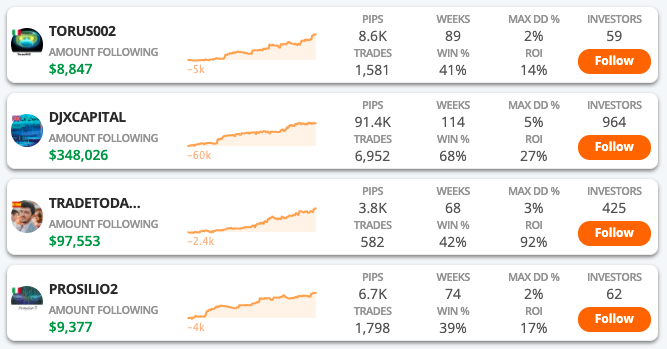

BlackBull Social

Connect with expert traders across the world. BlackBull Social is a powerful platform that allows you to execute trades following the strategies of master traders. The ultra-low latency ecosystem means copy-trades are executed as close to the masters as possible. You can leverage the broker’s interactive environment and advanced monitoring features to social-proof the strategies you choose to follow.

The main functions include:

- Set advanced trade parameters

- Access dedicated 24/7 customer support

- Review the trade history of all master traders

- Review real-time reporting on all investments

- Connect with traders via exclusive social features

Assets & Markets

BlackBull Markets offers an impressive 26,000+ global instruments. This includes 64 forex pairs, CFDs on some of the world’s most popular indices and cryptocurrencies, commodities including oil and natural gas, plus gold and silver.

Stock trading is also available via leveraged CFDs and on underlying shares.

Blackbull Markets Fees

BlackBull Markets trading fees are competitive, though these costs vary by account type and instrument. The broker charges no commission on the ECN Standard profile, with spreads from 0.8 pips. Clients using the ECN Prime account will incur tighter spreads from 0.1 pips, with commissions from $6 per lot. Advanced investors trading under the ECN Institutional account type can benefit from negotiable commission rates and spreads from 0.0 pips.

Swap fees apply for keeping positions open overnight.

When we used the BlackBull Markets platform, we were pleased with no account opening costs or inactivity fees for dormant profiles.

Leverage Review

The broker offers substantial margin trading opportunities with a maximum leverage of 1:500 available on currency pairs and precious metals. For energies and indices, you can utilize leverage up to 1:100. Although investing with significant leverage can increase profit prospects, it can also increase losses. Ensure you have appropriate risk management strategies in place. We would not recommend beginners use a high leverage ratio when getting started. Margin call calculations are explained in the Product Disclosure Statement.

Mobile Trading

All platforms are available with mobile compatibility, including free downloads to iOS and Android devices. When we used the apps on a portable device, our experts confirmed all options are fully functional with interactive navigator windows.

MT4 and MT5 permit access to all trading indicators, drawing tools, and automated functionalities found within the web-based platforms.

The broker also offers the ZuluTrade mobile app, a social copy-trading platform available on iPhone, iPad, and Android.

Deposits & Withdrawals

Deposits are accepted in nine currencies including USD, EUR, GBP, JPY and AUD. When we used the BlackBull Markets terminal, we were pleased to see all payment methods are free, although third-party charges may apply.

Available deposit methods include:

- Skrill

- Neteller

- FasaPay

- China Union Pay

- Bank Wire Transfer

- Credit/Debit Cards (Visa & MasterCard)

All payments are processed instantly, apart from bank wire transfers which can take up to three working days for funds to clear.

Withdrawals must be made using the same method that you originally deposited. The broker aims to process withdrawals within 24 hours. Fees apply at 5.00 in the base account currency for credit/debit cards, Neteller, Skrill, and international bank wire transfers.

Demo Account Review

BlackBull Markets offers a 30-day demo simulator with up to $100,000 in virtual funds. Users can choose between the Standard or Prime account and set their own leverage level up to 1:500. A demo account is a useful tool to test out trades and access real market data before experiencing the real thing.

BlackBull Markets Bonuses

At the time of writing, there are no promotional offers available at BlackBull Markets. Traders can check the broker’s website or social media pages for any future deals.

Regulation & Licensing

Black Bull Group Limited is incorporated and registered in New Zealand, regulated by the local Financial Markets Authority (FMA). The brokerage is also registered with the Financial Services Provider Registry (FSPR) with license number FSP403326 and is a member of the Financial Services Complaints Limited (FSCL) dispute resolution scheme.

Global clients may trade under the BBG Limited subsidiary, registered in the Seychelles and regulated by the Financial Services Authority (SVGFSA). The levels of support and protection may vary depending on the entity.

The broker maintains a strict Anti-Money Laundering (AML) / Counter Financing of Terrorism (CFT) policy.

Additional Features

Day traders can make use of social trading tools such as Myfxbook, HokoCloud and ZuluTrade. The broker also offers free VPS services for traders who meet certain criteria, including NYC Servers and BeeksFX. Institutional clients can also access prime services and PAMM accounts.

It is good to see various educational resources, ideal for beginners. This includes MT4 videos, forex analysis guides, and a trading glossary.

There is also an economic calendar to keep an eye on market news and events.

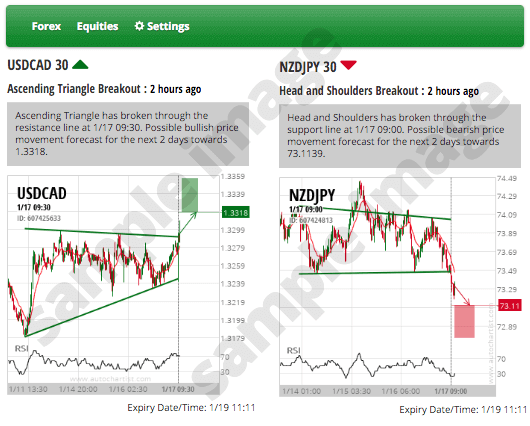

The online broker partnered with Autochartist in 2022 to offer powerful market analytics and automated opportunity identification. The plugin, which is integrated with MT4 and MT5, scans the markets and alerts users to potential trading opportunities.

It uses pattern recognition technology to monitor the markets 24/7 and is an important feature in many traders’ toolkits.

Account Types

Blackbull Markets offers three account types to day traders; ECN Standard, ECN Prime, and ECN Institutional. Packages have been tailor-made to suit clients needs, with varying initial investment values. All accounts have access to leverage up to 1:500, all instruments and a minimum lot size of 0.01.

We outline the features of each profile below:

Standard Account

The Standard Account type is perfect for beginners. With no commissions applicable and low spreads, it’s easy to get started.

- NY4 equinix server

- $0 minimum deposit

- Spreads from 0.8 pips

Prime Account

The most popular profile with a true ECN experience using direct to market processing.

- NY4 equinix server

- Spreads from 0.1 pips

- $2000 minimum deposit

- Commission from $6 per lot

Institutional Account

For retail traders looking for institutional services and advanced functionality.

- Spreads from 0.0 pips

- $20,000 minimum deposit

- Commission from $3 per lot

- Custom equinix server options

It is quick and easy to open a new account. To register, select ‘Sign Up’ on the top right of each web page. Complete the application form and provide the relevant verification details including identity documentation.

Note, Islamic accounts and Active Trader accounts are available for eligible clients.

Benefits

- Autochartist plugin

- 26,000+ instruments

- Negative balance protection

- Responsive customer service

- Range of platforms and tools

- Plenty of educational content

- Commission-free trading available

- ZuluTrade, HokoCloud and Myfxbook copy trading

Drawbacks

- Withdrawal fees

- US clients not accepted

Trading Hours

The default server time in MT4 is GMT+2 (GMT+3 DST). Trading hours will vary by instrument. Server times for forex are 00:00 – 24:00 Monday to Friday. For metals, trading times are 01:00 – 24:00 Monday to Thursday and 01:00 – 23:00 on Friday. Sessions are 01:00 – 24:00 for crude oil and 03:00 – 24:00 for brent oil (Monday to Friday).

Keep an eye on the latest session timetables via the broker’s terminal interface. This is particularly useful to stay up to date with upcoming market closures such as public holidays.

Customer Support

You can contact the customer support team via several methods, including telephone, email, and 24/7 live chat.

- Telephone – (+64) 9 558 5142

- Email – support@blackbullmarkets.com

- Office – Level 22, 120 Albert Street, Auckland 1010, New Zealand

Security & Safety

BlackBull Markets adheres to segregated client funds in top-tier banks and offers negative balance protection.

Additionally, the company is registered with the FSPR meaning strict legislation must be followed. AML and KYC policies are operational for all new client registrations and ongoing.

Overall, we’re comfortable BlackBull Markets isn’t a scam.

BlackBull Markets Verdict

Our review of BlackBull Markets has uncovered several good reasons to open a live account, including access to competitive spreads and a wide choice of platforms and tools. Regulation and customer protection will vary between the trading entity. Utilize demo profile services before opening a real account.

Accepted Countries

BlackBull Markets accepts traders from Australia, Thailand, Canada, United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar and most other countries.

Traders can not use BlackBull Markets from United States.